People often contact us to ask about how to go about starting a small business. Here are some of the questions that seem to come up most frequently, together with our responses:

I’m thinking about turning my hobby into a business. Do I have to form a company so I can test out my concept?

Simple answer: No. There are three basic business structures in New Zealand: sole trader, partnership and company. Most businesses start as sole traders, then progress to partnership or company status later.

You can ‘test the waters’ as a sole trader (the simplest way to start), choosing whatever trading name you like, provided it does not conflict with an existing business name or brand, or is confusingly close to an existing name or brand. For example, you might decide to trade as ‘Susan Brown Craft Products’. Provided no one else is using this name, or something very similar, you should be able to order your signage and stationery.

How do I check if someone else is using my preferred trading name?

Because there is no central register that we’re aware of in New Zealand of ‘sole trader’ trading names.

For companies it’s different. You can find out if someone else is already using your proposed company name by visiting www.companies.govt.nz and completing a name search. We suggest you search this site first anyway to see if a company is using your proposed trading name.

Then, check there’s no similar or identical listing in either the White Pages or the Yellow Pages. Double check by searching your local phone book. As a final check, search for similar names through www.google.co.nz or other local search engines.

If all these avenues show no one is using your preferred trading name, you should be in the clear to go ahead. If by some unfortunate chance someone else is using the same name, you can at least show that you’ve made a serious attempt to find a match.

Must I register somewhere before I start?

If you form a company, then various formal steps are required. But even if you start as a sole trader, you should notify the Inland Revenue Department so that they can record you are self-employed. There are three good reasons for this:

- To register for accident cover.

Inland Revenue will in turn notify ACC to provide you with the appropriate cover. Otherwise, if you have an accident, you may not have your claim accepted from the date you say you went into business unless the date has been recorded somewhere (with the IRD in this case). This applies both to the start of a full-time enterprise and to the start of a part-time business (such as in the evenings) while you’re still employed.

- So that IRD can correctly code the computer to send you the appropriate Business Tax forms at the end of each financial year.

These forms will help to remind you of your obligations.

- To help you with your claims for business expenses.

The reason for this is that Inland Revenue is unlikely to let you claim for equipment you bought some time ago when you were operating as a hobby. So, if you want to claim legitimate business expenses, such as extra equipment you might need to buy, stationery, signage, etc., start keeping proper records immediately and let the IRD know you’re ‘in business’. You can then give your records to your bookkeeper or accountant at the end of your first financial year. Note: the most common ending for the financial year is the 31 March. Even if you haven’t been trading for a full 12 months before the 31 March, you should still give your records to a bookkeeper or accountant for them to prepare a return for the Inland Revenue Department.

Here’s a tip: the best way to let the IRD know of your intentions is by phone. But remember that the IRD phone lines are open until 8pm each weeknight, and to 1pm on a Saturday. So ring after normal business hours: it’s quicker.

If I am starting as a sole trader, should I open a separate bank account?

Yes, this will make life much easier for you and for your accountant, because this step allows you to separate clearly your business income and expenses from your private income and expenses. Visit your bank and ask for a separate account. Before the bank can open a separate business bank account they will need a business IRD number.

As a sole trader your business IRD number will usually be the same as your existing personal one (but check this out with the IRD beforehand). This separate business account will typically be named something like ‘Susan Brown trading as Susan Brown Craft Products’ (or whatever). The bank statements are usually the prime source of information for your accountant or bookkeeper when they come to put together your accounts at the end of your first year trading.

Make life even easier for yourself by getting a cash card from the bank in your trading name. This way, instead of running a separate petty cash account, you can use the cash card to pay for minor purchases (like stationery) through EFTPOS. All these transactions will be neatly listed on your business bank statements and you can just staple the relevant EFTPOS till receipts and invoices to the bank statement each month. No need to carry cash around or worry about balancing a petty cash account. A similar tactic is to use a business credit card. Make sure though, that you receive and keep proper GST invoices for all your purchases.

Should I use an accountant or lawyer?

You can trade and put in your own tax returns, or you can use a bookkeeper (someone skilled at keeping books who is not a fully qualified chartered accountant). I recommend though, that you find an accountant. Very few successful small businesses function without one. You’re unlikely to be aware of all aspects of the tax system. Also friends already in business for recommendations, and choose an accountant who works with other small businesses. Your accountant should be able to save you money and stress by advising what you can claim and how, as well as giving you advice on how to set up basic bookkeeping system.

It’s also a very good idea to consult a lawyer about your business intentions. Certainly do so if you intend signing a lease or any legal document. Depending on your business, a lawyer might advise you to take out public liability insurance or other forms of protection.

Should I approach the Inland Revenue Department?

Yes, don’t be afraid to contact the IRD. Too many small business people view Inland Revenue as a bogeyman best left as undisturbed as possible. “Send them money regularly and hope they leave me alone!” seems to be a common attitude. In fact, part of Inland Revenue’s job is to offer help and information, particularly for new businesses.

You’ll find their website www.ird.govt.nz very useful for answering your basic questions about setting up a business and by phoning 0800 377 774 you can also arrange to speak to a Business Tax Information Officer.

The web site lists various helpful publications you can order, pick up from your local IRD office, or download from the site itself. There’s also a good FAQ (Frequently Asked Questions) section.

Your tax dollars fund this service, so why not make full use of it? You can ask for free advice even if you’re just thinking about starting a business.

Should I write a business plan for my business?

We recommend you complete a Business Plan. Three good reasons:

- Firstly, the research and thought you’ll have put into writing the business plan will help you sharpen and/or adjust your ideas.

- Secondly, any lending institution that you might approach for funds, such as a bank, will want evidence that you’ve done your homework and properly thought through your business concept.

- Thirdly, the business plan provides a road map for your business. It lays out what you intend doing, how you intend to do it, the resources you need, and your action deadlines for each stage. The business plan forms a ‘living document’ that you can then revisit at regular intervals and modify according to your progress or changing circumstances.

Business.govt.nz has a great template here.

Do I need business skills or experience to start a small business?

The failure rate of small business start-ups is high. One major reason is lack of business skills. Therefore yes, you should systematically set about improving your business skills.

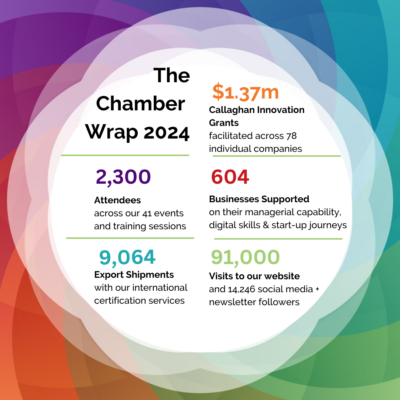

The Chamber offers regular training sessions, so contact our team to talk about how we can help you.

The most important ingredient you need to succeed is enthusiasm and drive, backed by persistence and a determination to achieve your goals no matter how much hard work is involved.

But you’ll greatly improve your chances of success if you have good business skills. These include the skills to market your business in a creative and sustained way and the skills to build and manage efficient business systems that enable the business to operate smoothly.

Many people start small businesses because they’re very good at something, like making things, or being an electrician, or offering specialist knowledge, like computer installations, or public relations work. They often fail because their other business skills are poor, or they couldn’t be bothered with them. It seems more fun to do what you enjoy doing than to keep the book work up to date, chase debtors, invoice promptly, do a cash flow forecast or manage tax liabilities, so these tasks are neglected, and the business suffers.

Another major reason for failure is lack of experience in the chosen industry. The solution is to work in the industry before you start or buy that business – even if you have to work for low wages or just for the work experience. The idea of running a Bed & Breakfast might sound dandy, until you’ve actually tried it and learned about some of the difficulties. Buying a hot bread shop with all those fresh pastries on display might seem great until you realise that bakers often have to get up around 3am to start the baking process for the day.

My advice is to learn about the advantages and the disadvantages of the industry you’re interested in before you take the plunge.